Britain’s First Wavepool Has Closed — What Really Happened?

Bankruptcy, social media hackings, debts unpaid — and yet, reopening looms.

Editors note: after the shutdown, The Wave is open once more.

Skip your mind back a couple decades. Is there a world where you imagined surf media dominated by announcements of artificial wave complexes, not as novelties, but as master-planned utopias?

It’s the old commune-on-a-farm-near-a-wave model, only this time instead of growing your own food and polyamorous collapse, it’s parents sipping martinis while berating their nine-year-old for not stomping an air-rev in the golden hour slot.

But not all is well in wavepool world. Britain’s original tub, The Wave, is currently enduring a very public, very unsexy financial breakdown. Gotta crack a few eggs to make an omelette, eh?

The Wave Bristol opened in 2019 and ran, without major incident, as Britain’s first public artificial wave for six solid years. Until last Thursday, when it ceased doing any of that. Shut the gates to customers, cancelled bookings, froze its website, and slipped into a strange new phase of unhinged online behaviour.

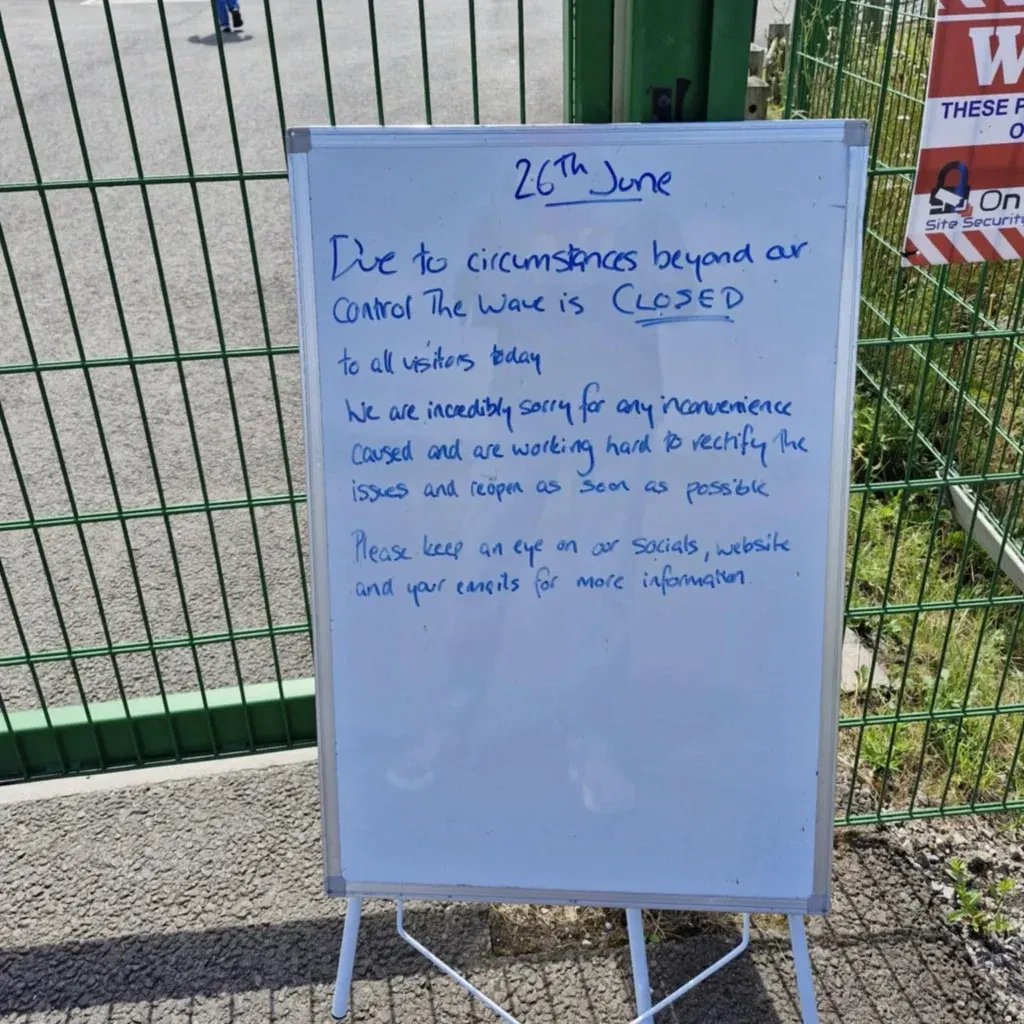

“Due to circumstances beyond our control, the wave is closed,” read the whiteboard sign parked out the front of the gates. What’s beneath the press release?

Well, a social media meltdown, to begin with. Let’s unpack.

“On the 27 June 2025, The Wave Bristol, having been placed into a technical insolvency the day before, was sold by administrator BTG,” began the whistleblower Instagram admin. “These actions have removed the business from the investors and staff that have built and grown the park. Several parties have pursued personal returns, significantly acting out of step with moral fiduciary and duties.”

And then: “The sequence of events, in immediate hindsight, now appears to have been long planned to undermine all efforts to deliver a full re-finance in an orderly fashion. Instead, issues have been raised over the past month and over the last several hours, specifically aimed at achieving this contrived and money-orientated goal.”

Ahem.

Shortly after, the post vanished. Then The Wave returned to social media with a new line: they’d been hacked.

“Booking systems, staff emails, and our website/social media channels were broken into and passwords changed,” read the post. “A ransom attack is suspected but at this time the attacking party is yet to make their demands. The police have been notified.”

Insider beef? The plot thickens.

So, what actually happened?

Let’s take a quick crash course in corporate wave-making. Surf Bristol Limited (SBL) runs The Wave. It’s part of The Wave Group Ltd (TWGL), which in 2023 took on major investment from private equity firm Sullivan Street Partners. To build it, a cousin company called JAR Wave Ltd (JWL) loaned £15 million, secured against SBL’s assets — with another group player, JAR Real Estate Fund PCC Limited (JRE), holding a slice of the collateral cake.

Construction costs ballooned. Then COVID showed up and emptied the tank. SBL needed more cash, so in 2020 it borrowed again — this time from JRE directly. In 2022, JWL threw another £2 million into the mix through the parent company, The Wave Group Ltd (TWGL), to pay off that second loan.

Meanwhile, the original £15 million loan sat there, unpaid.

By April 2023, JWL’s patience ran out. SBL had ceased interest payments, so it locked down company assets, and the loan entered what was described as a ‘freezing order’. Talks around debt restructuring continued through early 2025, but went nowhere.

Late 2024: JWL called in BTG Advisory, insolvency pros, to figure out how to get paid. Early 2025: still no deal.

- April 2: JWL fired off a formal “pay up in seven days or else” letter.

- April 17: notice of intention to appoint administrators sworn.

- April 22: court rubber-stamped administrators.

- June 26: the business was sold.

- June 27: the gates slammed shut.

And here we are. But where, exactly, is that?

To oversimplify, it’s a messy financial standoff between majority owners Sullivan Street Partners and JWL.

According to the BBC, Sullivan Street Partners say the shutdown wasn’t necessary. They claim the whole mess stems from the bankruptcy of a director connected to JWL, and that it triggered a premature fire sale.

Their statement: “The Wave Group… has lined up a refinancing alongside its exciting London developments, which would see all creditors repaid in full within a week and is offering to continue to operate the park.”

Sullivan Street invested £27 million into The Wave in 2023.

Wave CEO Hazel Geary added: “This decision has not been driven by operational failure or lack of customer demand — but by a financial technicality completely unrelated to commercial matters.” Then she was promptly replaced by Julian Topham. Unclear if this, too, was unrelated to commercial matters.

As of right now, emails to The Wave bounce back. The website’s technically up, but bookings remain frozen.

Surfers scheduled for the English Para Surfing Champs on Wednesday, July 2nd, are reportedly unsure whether to show up. Zoe Smith, a regular para surfer there, commented on Facebook:

“A moderate investor has declared bankruptcy. The Wave didn’t see it coming and have tried everything to fix it. Even a minor investor can impact legal insurance, cash flow, regulatory licenses, and so on. They have to close temporarily to sort it out as insolvency kills insurance.”

Zoe predicts The Wave will reopen within a few days.

In short: I went to The Wave Bristol, and all I got was this lousy whiteboard saying “closed due to circumstances beyond our control.”

This marks the second UK wavepool to shut its doors, following Surf Snowdonia in Wales. It ain’t always sunshine and rainbows when investing millions into artificial waves.

Surf parks are the future of surfing, right?

Comments

Comments are a Stab Premium feature. Gotta join to talk shop.

Already a member? Sign In

Want to join? Sign Up