Finally: Bluestar Alliance Speaks On The Hurley Buyout And Mega-Cuts

Here’s what it means for the surf industrial complex.

In 1996, an investment led by veteran apparel industry executive Marvin Winkler acquired Gotcha.

At the time of sale, Gotcha—a company that started in a Southern California garage—employed 180 people and enjoyed annual sales of $90 million. They did it all selling t-shirts in surf shops and department stores like Nordstrom. They also owned MCD, which focused specifically on surf and snowboard apparel and was sold exclusively at core shops.

By 2002 Gotcha was filing Chapter 11 bankruptcy, owing creditors over $3 million. Gotcha has come and gone since, but it will never be what it once was.

Failed takeovers of surfing’s biggest brand have literally been going on since the surf industry was born in the ‘70s.

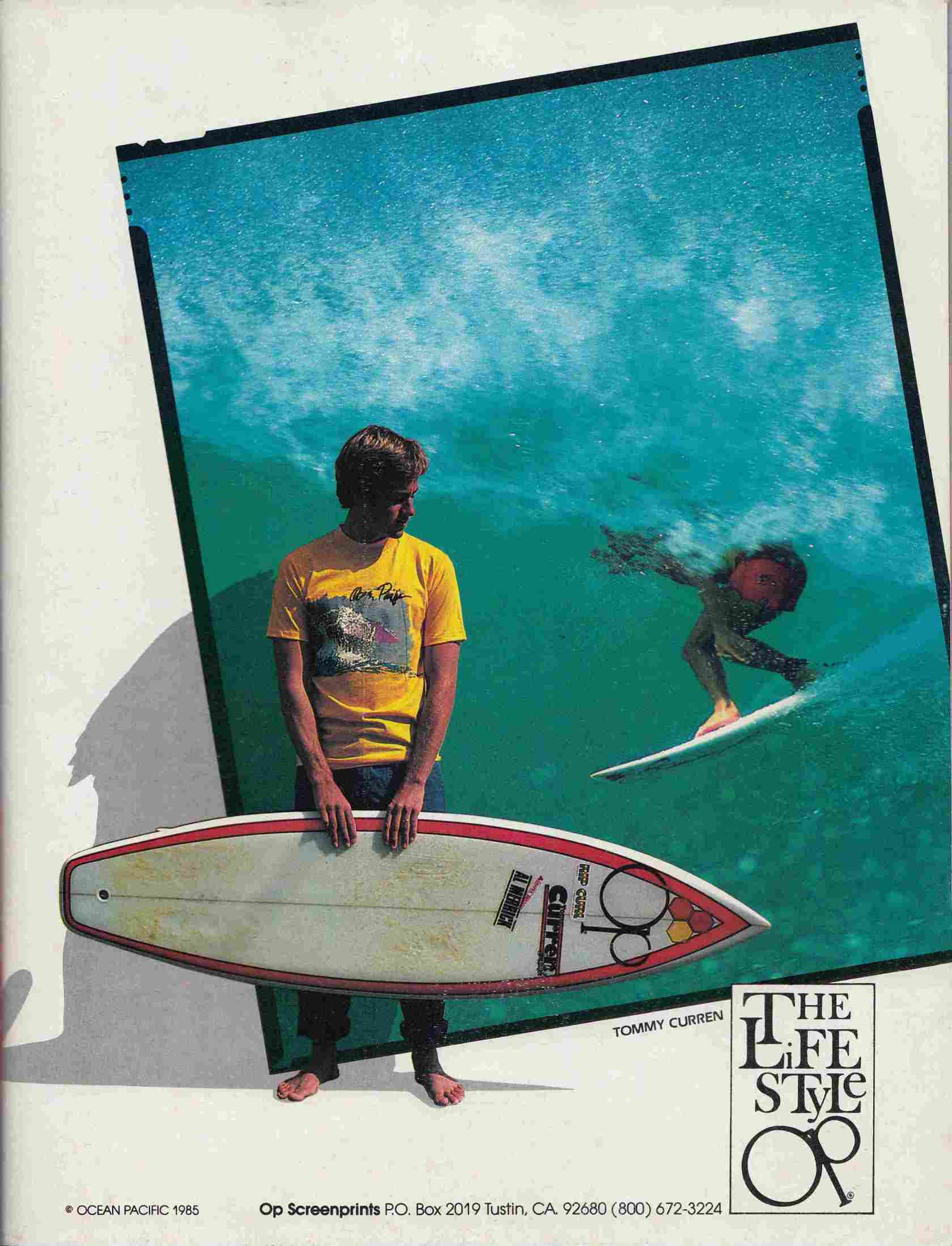

Pissing away their brand equity, brands like Lightning Bolt, Ocean Pacific, and Body Glove paved the way with buyouts and reckless licensing agreements.

At its height in 1989, OP’s revenue topped $370 million; In 2004, Warnaco Corporation—the makers of Speedo—acquired the company for $40 million.

Today, Bluestar Alliance broke its silence on the Hurley acquisition, with a Press Release aimed at clearing the smoke from the fire sale, and if you can bear the eye-rolling corpo-speak, you should read the entire thing:

NEW YORK, NEW YORK – January 20, 2020 – Bluestar Alliance, LLC (BSA) has gone forward to rebuild Hurley’s core infrastructure and has poised the brand for exceptional growth. Focusing on what Hurley represents, the new plan encompasses much of the original Hurley vision: to be the epicenter of all things Surf, Skate, Snow, Art, Music & Culture.

Earlier this year Hurley announced a restructuring of its corporate workforce to align its organization with the company’s go-forward strategy. According to CEO, Joseph Gabbay, “As part of this restructuring, 56 jobs were unfortunately eliminated. This was a very difficult decision that had to be made in order to implement a sustainable plan for long-term growth. We could not continue to replicate the prior model, but that does not mean we don’t respect the brand, it’s culture or the people that have helped build it. No one wants to have to make these difficult decisions, but they were necessary if Hurley was to go forward.“

“When we acquired Hurley we outlined three priorities,” said Ralph Gindi, Chief Operating Officer. “Changing the trajectory of our overall Surf business; developing and right-sizing the Hurley marketing strategy while expanding the focus beyond surf–into Skate, Snow, Music and Art; and finally, putting the best in class licensing partners in place to expand the brand footprint into a full lifestyle brand.” Under the previous ownership, Hurley spent years focused only on product in the Surf arena. With the current strategy Hurley will have the opportunity to broaden its category base into a 365 day a year brand, across Men’s, Women’s & Kids.

The business has quickly transitioned into the newly licensed model. But while doing so, Hurley and their respective licensees worked hard to keep key the Brand heritage, as well as allowing specialized manufacturing companies to focus on a broader range of product categories. “We have worked diligently to bring on companies who can offer the best product available to the market—and in turn to the Hurley consumer. Our model allows companies with a broad range of capabilities to manufacture the best, hottest and most innovative products in the market. Authenticity is key.”

Hurley will keep its long-standing licensee partnership with United Legwear. The company has been responsible for the Men’s apparel that has been the core of Hurley for many years and remains a large part of the new strategy. “Prior ownership entrusted outside partners to manufacture their product, and we made it a point to not only retain those partnerships, but to grow them. United Legwear hired key members of the Hurley product, sales and innovation teams and will continue to deliver the Hurley product that is expected by discerning athletes and fans.”

Another key move is the acquisition of Hurley’s operations in Barcelona, Spain, by David Meire and Javier Carrea. David Meire has over 20 years’ experience as VP & GM of Football at Nike, while Javier Carrera was also a VP & GM for Quiksilver & Nike. They will operate under a new distribution agreement for the EMEA (Europe, Middle East and Africa) territory, and have the experience to expand the business across all categories of product.

One thing Hurley is not doing is changing its distribution model. “Honoring the better retailers is our number 1 priority,” says Gabbay. “The quality of the product will continue to be the best in the market, and the retailers we work with will remain within the scope of the current Hurley customers. While the plan is to grow the more broadly and diversify the product categories, the intent is to have Hurley remain a premier resource in Surf and beyond.”

The Costa Mesa site, where Hurley was born, remains crucial to the global strategy as it is a testament to the brand’s heritage and future Development.

“Costa Mesa is the hub of our surf design and development, and will still employ 90+ people in design, production and sales, primarily based in the current corporate headquarters,” says Gabbay. “It will also remain the cultural center for the brand as we look to reintroduce on-campus events and initiatives.”

Hurley Retail has remained successful and has continued to be a force even through a difficult retail climate. The current retail leadership remains intact and Hurley has added several positions. All in all, Hurley Retail employs approximately 320 full & part-time individuals. The current field team is extremely valuable and continues to ensure the stores enhance the level of service and product offered to the Hurley customer.

With Surf premiering at this Summer’s Olympics, and the core DNA of the brand, Hurley’s current marketing proudly includes top athletes and brand ambassadors like Kolohe Andino, Julian Wilson, Filipe Toledo, Kai Lenny and Koa Smith.

“We will continue to focus on major competitive sponsorships in Surf but will be looking for other action sport initiatives,” says Gindi. “Tying in the right athletes, celebrities and influencers, in an inclusive way, is our goal. We want more, not less. There are several exciting deals in the works that we will announce over the coming weeks.”

Yet while Surf is still Hurley’s top priority, and the soul of the brand, broadening Hurley’s scope overall has required a few changes to the Surf program. The shift will ultimately allow for growth and partnerships outside of a star athlete roster. Gindi stresses “the importance of youth programs and community outreach.”

In the most recent years, the athlete program was not aligned with the business, in order to survive there had to be change.

“Under this new organizational structure, we are positioned to accelerate profitable growth while still honoring the brand DNA. We will not sway from the core, and we will continue to serve our current customer base, focusing on the youth and deploying the necessary resources to expand the Hurley lifestyle brand domestically and internationally.”

If you made it through that endless puddle of word-vomit, congratulations. You’ve just earned yourself a two-hour surf. Close the lappy, put the phone on airplane mode, and enjoy.

Surf Intermission (duration: 2 hours)

Okay, you’re back! I hope the salt scrubbed your internal browsing history clean. Now, let’s break down what we wish we never read.

Keypoints:

– Under control of Bluestar, Hurley will shift its focus from primarily surf to equal parts surf, skate, snow, arts, music, and culture. The objective here is to increase Hurley’s market demo and therefore sales. While this can work as a business strategy (see: Vans), it more often than not deters the original audience (surfers) and has little appeal to the added sectors.

– Bluestar talks about “right-sizing” the Hurley marketing team (they cut 56 employees) and diverging from the “prior model” of business, which is fair, because whatever Hurley has been doing for the past umpteen years clearly hasn’t been working on the P&L sheets.

– While they will be licensing the production side of the business, Bluestar says they will not be changing their distribution model, meaning they will continue to focus on the “better retailers” (their words) and not super-cheap megastores (which is what most presumed would happen). But it’s a bit unclear what that actually means since Hurley had been heavily reliant on Nike distro channels.

– In reference to their recently decimated surf team, Bluestar apparently made these cuts to create space for athletes of other disciplines (snow, skate, etc.). This aligns with Hurley’s plans to market to those sectors. They also mentioned that they’ll keep a sharp focus on youth athletes, which is presumably where they receive a large portion of their sales.

So, that’s what’s going on in Costa Mesa and beyond. But how does Hurley’s situation compare to other ongoing corporate buyouts?

Like Hurley, Rip Curl, Quiksilver, and Volcom were all garage brands that blossomed into behemoths before investment firms came knocking with fists full of cash. Their final chapters have yet to be written.

Nobody leveraged this early corporate wheeling and dealing better than Danny Kwock. In Phil Jarrett’s “Salts and Suits,” he details how Kwock, Quiksilver’s marketing genius throughout the ‘80s, was working for the Mountain And The Wave in the early-’90s while also investing in and propping up Volcom at the same time. He was eventually shown the door at Quik, for obvious conflicts of interest, but not before he had secured stock options in both Quik and Volcom.

Kwock made out like the thief in the night that he always was, literally—as the legend goes, Kwock got his start in the industry when Quiksilver’s Bob McKnight caught him breaking into their Costa Mesa warehouse, and instead of pressing charges hired him…

On June 30, 2005, Volcom went public, and according to Jarret, “Kwock, a founding shareholder in Volcom back in 1991, had already made millions before breakfast.”

When the first day of trading VLCM stock closed on the NASDAQ, Kwock was worth $50 million more.

2005 was the same year VF Corp took Reef off the hands of Fernando and Santiago Aguerre for a cool $187 million. The year prior VF had acquired Vans in a $389 million deal (which considering Vans’ domination of their space, was one of the rare wise investments).

Freed from financial constraints, after the sale Fernando dedicated himself to the dream of getting surfing in the Olympics, which is about to be realized.

So does the populist criticism of the “too big to fail”-era of big brands hold up? With Vans as an outlier, judging by what’s happening at Hurley, the bigger you are the more you apt you are to fail. Even Nike’s money couldn’t save them.

Surf brands are at their best when they’re bursting at the seams. It’s that punk, “we’ll fucking do it ourselves” ethos that has driven the best moments in the business. The early days of brands like Volcom and RVCA are a perfect example. The Volcom Stone logo in the armpit; the red stitches on RVCA’s tees—they meant something. Those nuances subtly set the brands apart from the herd. They had clout. They had core appeal. They differentiated between what was happening in a midwestern mall and what was happening on the beach or in the parking lot.

But once a whole lot of risky money and a bunch of suits holding seats as Board of Directors enters into the equation the game changes.

As they say, if you don’t learn from the past you’re doomed to repeat it. So, how does the surf industry move forward now? And what are the brands that are going to lead us to the promised land?

There is no shortage of opportunity out there. The big brands are desperately clinging to relevance while there are more and more surfers around the world than ever before—most who, rightly or wrongly, could give two shits about a logo tee and $150 pair of boardshorts. Da Hui sells their boardshorts at Costco in Hawaii… and they kill it.

There are new and emerging surf cultures all over the planet that have all kinds of growth potential. But the strategy and approach has to change. Surfers have to put themselves back in positions of authority and control. And customers have to be more educated on how they spend their money.

“For surfers, by surfers.”

The most political decision we have in 2020—whether at a surf shop or the grocery and department store, for that matter—is where we choose to spend our coin.

When you’re running a surf brand, it doesn’t matter if you have a room full of really smart people if they don’t surf. When decision-makers stop being surfers you get things like hundreds of thousands of neoprene CD cases—Body Glove’s number one selling product, and the perfect metaphor for the legacy it leaves behind.

Comments

Comments are a Stab Premium feature. Gotta join to talk shop.

Already a member? Sign In

Want to join? Sign Up